On 17 December 2025, the High Court handed down judgment in R (Kadas) v Commissioners For His Majesty’s Revenue and Customs [2025] EWHC 3322 (Admin) (judgment available here).

The Court dismissed a challenge by the Claimant, a high net worth individual, to HMRC’s decision to transfer information concerning his personal finances to the Spanish tax authorities under international tax transparency legislation (art. 26 of the Double Tax Convention between the UK and Spain).

The Claimant had alleged that HMRC had unlawfully assumed that the Spanish tax authority was exercising its investigative powers honestly and in good faith, when there was reason to believe that the contrary was true. The Court’s judgment provides important guidance on the scope for a challenge to an international data transfer on the basis of allegations of bad faith or improper conduct by the recipient authority, the degree of respect to be paid by the Court to HMRC’s technical judgments, and the admissibility of ex post facto evidence in judicial review.

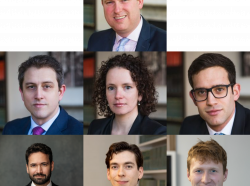

Rupert Paines and Rita Dias acted for HMRC, instructed by HMRC Legal Group.